The UK Property reporting service and its interaction with self-assessment

In recent weeks we have received a number of reports expressing concern about the interaction between the UK Property Reporting Service and self-assessment, particularly in the case where an individual has been charged (and paid) more CGT following the in-year report of their disposal via the service than is due under self-assessment and is now seeking a refund.

Following a report under the UK Property Reporting service, a UK resident individual may find that they have overpaid their CGT if, for example, their income is lower than expected, or because a capital loss on an asset other than UK residential property was realised after the completion of the residential property disposal. (Similar rules apply for non-UK residents but we are focusing on the position for UK residents here.)

An individual who is within self-assessment and who has reported one or more disposals through the UK Property Reporting service in the tax year should include these disposals on their self-assessment return. For disposals of UK residential property by UK residents, the total gains or losses reported in-year should be included in box 9 of the SA108 pages and the total tax payable in box 10. Where the problem arises is if the total tax reported as payable in box 10 exceeds the individual’s total CGT bill from all disposals, so that they are due a refund. In these cases, the HMRC computation will not show the amount as a refund on the self-assessment account, nor will it be off-set against other self-assessment liabilities as might be expected.

We and other professional bodies have been in discussion with HMRC over this and other issues, and HMRC have now issued the following guidance for members on what to do when an individual has overpaid CGT arising on disposals through the UK residential property return. In these cases, if the individual is unable to amend the return via the UK property reporting service to obtain a refund via that route, they will need to ring HMRC to request a manual adjustment and to offset any overpayments against their wider self-assessment bill. (We are currently seeking specific confirmation that agents can also call to make these adjustments.)

This is an interim solution for 2020/21 tax returns while HMRC work to see if a better solution can be found. HMRC appreciate that the requirement to contact HMRC by phone creates additional work for agents and we are aware many members will be dissatisfied with the proposed approach, but because of the way HMRC's systems are set up, it is currently impossible to automate a solution. We are in discussions to see if there are any alternatives and if this can be improved for 2021/22 tax returns.

Please note that HMRC’s guidance below does not cover in the detail the wider issue of when an individual is allowed under the relevant legislation to make amendments to a return made under the UK Property Reporting service and when a revision can only be made via the self-assessment process. Before submitting a revised UK Property return in respect of any disposal, members should consider where or not they are permitted to do so under the legislation.

For reference, the rules on when an individual can amend estimated figures in their UK property return is set out in para 15 of Schedule 2 FA2019, and the rules on amendments in para 19.

Our understanding of the legislation is that where any figures which were estimated or apportioned become known, or it becomes reasonable to make a different estimate of the rate of CGT applying to the disposal or whether or not a relief will apply, a new UK Property return can be submitted containing the new facts to replace the originally submitted return.

In respect of amendments to the property return, these can only be made in specific circumstances. The legislation says that ‘An amendment is permitted only so far as the return under this Schedule could, when originally delivered, have included the amendment by reference to things already done’. Amendments to a UK Property return cannot be made after a self-assessment return has been submitted including the disposal or after the deadline for the individual’s self-assessment return.

We are working with HMRC to improve the guidance in respect of estimates and amendments. In the meantime, we have reproduced their guidance on off-setting overpaid CGT via the UK Property Reporting service below.

Guidance received from HMRC on 25 June in respect of the offset of UK Property Disposal Capital Gains Tax

- After submitting an in-year UK Property Disposals return, if the user needs to amend their return, they can do so via the UK Property Disposals return service or via their Self Assessment tax return. [ATT comment - please see comments above when amendments can be made to a property return]

- If they amend via the UK Property Disposals return service, and their liability reduces, they can claim a repayment via the service. This will then be processed by HMRC.

- If the user chooses to amend [ATT comment - or is required to amend] via Self Assessment, they should complete the Self Assessment tax return with their overall Capital Gains Tax (CGT) residential property gains and the total gains or losses and tax charged via the UK Property Disposals return service.

- After all relevant sections of the Self Assessment tax return are completed, the user should go to view the calculation section and tick the option to View and print your full calculation.

-

The user can then pay the difference between the Income Tax, CGT and Class 2 NICs due figure and the CGT calculated as overpaid figure. Please note that the Self Assessment payment deadline is the 31 January following the tax year.

-

The user should then contact HMRC by telephone on 0300 200 3300 to enable HMRC to make a manual adjustment. If any further action is required by the user HMRC will contact them to advise what that is.

-

If the user chooses to make payment in full of the Income Tax, CGT and Class 2 NICs figure, they should contact HMRC to request a repayment of their overpayment. This will then be reviewed by HMRC.

-

Once the Self Assessment tax return has been submitted, the user should not attempt to amend their UK Property Disposals return for the corresponding tax year.

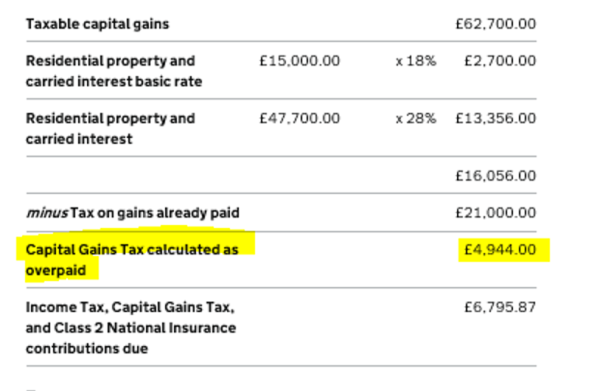

HMRC have also supplied the following example to illustrate the position. Here, the individual has £4,944.00 of overpaid CGT. They can offset this against their remaining SA liability of £6,795.87 and pay a net figure of £1,851.87 provided that they call HMRC to ask for the offset to be made manually with the process above.

We are continuing to work with HMRC on this and a number of other areas of concern regarding the UK Property Reporting service and feedback and comments from members to [email protected] are always welcome. More guidance on the UK Property Reporting service can be found in our 'user's guide' which is regularly updated.