Last updated: 25 November 2025, If you are reading this at a later date you are advised to check that that position has not changed in the time since.

This guide explains the restriction on carried forward loss relief introduced in April 2017, with a particular focus on the compliance requirements for claiming the Deductions Allowance (DA) and the potential consequences of non-compliance. The broader loss relief rules and the calculation of the DA are not covered in this guide.

Page contents

Finance (No2) Act 2017 changes

Deductions Allowance (DA)

Standalone Company Compliance Requirements

Group Compliance Requirements

Group Allowance Nomination

Group Allowance Allocation Statement (GAAS)

Practical considerations

Accounting periods straddling 1 April 2017

Further guidance

Finance (No2) Act 2017 changes

Finance (No2) Act 2017 introduced two key changes to Corporation Tax loss relief, effective from 1 April 2017:

- Greater flexibility in using carried forward losses that arose on or after 1 April 2017; and

- A restriction on the amount of brought forward losses that can be offset against profits, which applies to both pre and post-April 2017 losses.

Broadly, the amount of carried forward loss relief that can be claimed is restricted to the lower of:

- The unrelieved brought forward losses; or

- 50% of the company’s unrelieved profits.

|

Example 1 Amber Ltd is a standalone company with a year-end of 31 December. For the year ending 31 December 2024, the company has taxable profits of £200,000 and brought-forward trading losses of £400,000. The carried forward loss relief would be restricted to the lower of:

Carried forward loss relief would be restricted to £100,000. However, the amount of relief available may increase if Amber Ltd claims the DA (see Example 2). |

Deductions Allowance (DA)

The DA is a £5million allowance, pro-rated for accounting periods of less than 12 months. It is available to each standalone company for each accounting period.

Where a company is a member of a group, only one group DA of up to £5million is available per group, although this can be allocated between group companies as they see fit.

When a company claims the DA, the amount of carried forward loss relief that can be claimed is the lower of:

- The unrelieved brought forward losses; or

- The DA plus 50% of the company’s unrelieved profits above that amount.

This means a restriction only arises when losses exceed the DA.

|

Example 2 If Amber Ltd claims the DA, there would be no restriction to the carried forward loss relief claim. This is because the restriction is the lower of:

Therefore, Amber Ltd can claim carried forward loss relief of £200,000. If Amber Ltd fails to meet the compliance requirements, it will not be entitled to claim DA. In this case, its carried forward loss relief would be limited to £100,000 (see Example 1). |

|

Example 3 Baltic Ltd is a standalone company with a year-end of 31 December. For the year ending 31 December 2024, the company has taxable profits of £6,200,000 and brought-forward trading losses of £10,000,000. The carried forward loss relief would be restricted to the lower of:

Carried forward loss relief would be restricted to £3,100,000. Baltic Ltd would then carry forward trading losses of £6,900,000 (£10,000,000 - £3,100,000). However, the restricted amount may be increased if Baltic Ltd claims the DA. If Baltic Ltd claims the DA, the restriction is the lower of:

Therefore, Baltic Ltd can claim carried forward loss relief of £5,600,000. Baltic Ltd would then carry forward trading losses of £4,400,000 (£10,000,000 - £5,600,000). If Baltic Ltd fails to meet the compliance requirements, it will not be entitled to claim DA. In this case, its carried forward loss relief would be limited to £3,100,000 (See, above). |

Standalone Company Compliance Requirements

A standalone company must specify its DA amount. This specification must be included in the tax computations submitted with the tax return (CT600).

The CT600 tax return form has not been amended to reflect the new compliance requirements (there is no dedicated box for the DA on the CT600). HMRC have confirmed that the requirements will be met provided companies include a clear summary of the required information in the Corporation Tax computation accompanying their CT600.

This requirement applies regardless of the size of the company and must be complied with even if the company will not suffer any restriction (for example because its brought forward losses are well below £5m).

If a company fails to do this their DA will be nil and only 50% of their profits can be offset by brought forward losses.

Further requirements apply if a company has brought forward losses which can only be set against either trading or non-trading profits. For example, trading losses or non-trading loan relationship deficits which arose before 1 April 2017. Where this is the case, the company will need to identify a corresponding amount of their DA as being a trading profits DA or non-trading profits DA as appropriate and also specify this amount in their return.

If a company fails to specify the amount of their trading profits DA or non-trading profits DA, as appropriate, in their return then only 50% of their profits can be offset by brought forward losses, even if these fall well below the level of the DA. The general DA should also still be entered on the return but there is no statutory loss of the allowance where this doesn’t happen.

Group Compliance Requirements

As noted above, where a company is a member of a group, only one group DA of up to £5m is available per group, although this can be allocated between group companies as they see fit.

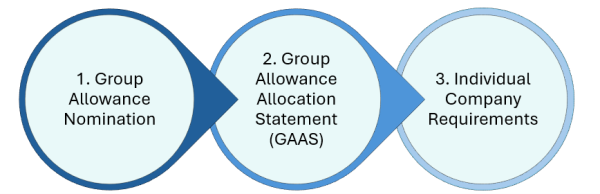

For groups, additional compliance steps are necessary:

In addition to the individual company requirements (see above) groups must also ensure that they make a Group Allowance Nomination and GAAS.

These requirements apply to even the simplest groups structures (including a holding company with a single trading company subsidiary).

Group Allowance Nomination

Groups are required to submit a Group Allowance Nomination to designate a company as the nominated company. Although there is no official template, the nomination should include the following details:

The effective date, which may be earlier than the date of the nomination;

- The name and UTR of the nominated company;

- The names of all group companies within the charge to Corporation Tax; and

- The nomination must be signed by an appropriate person (e.g., company secretary) on behalf of each company.

The nomination does not need to be submitted to HMRC, but it must be kept on file and made available for inspection if requested.

Group Allowance Allocation Statement (GAAS)

The nominated company must submit a GAAS to HMRC for each accounting period, detailing how the DA is allocated across the group.

- The GAAS should be filed within 12 months of the CT600 filing date (typically 12 months after the end of the accounting period).

- It must be submitted with the CT600 as a supporting document.

- A GAAS is not required if no group member is utilising carried forward losses.

HMRC’s GAAS template can be found here.

HMRC has confirmed that the nominated company can submit the GAAS in PDF format alongside their return.

Practical considerations

Given the above requirements, any time that a company makes a claim to use brought forward losses, the following questions need to be considered:

- Are any brought forward losses being set off against profits arising from 1 April 2017? If yes, include a figure for the DA in the return.

- Are any of those brought forward losses only available for offset against trading profits or non-trading profits? If yes, also include a figure for the trading profits DA or non-trading profits DA in the return as appropriate.

- Is the company a member of a group with at least one other company subject to Corporation Tax? If yes, the group will need make a Group Allowance Nomination and GAAS.

Accounting periods straddling 1 April 2017

As noted earlier, DAs need to be pro-rated for accounting periods of less than twelve months. For commencement purposes, where a company had an accounting period straddling 1 April 2017, the periods falling before and after that date were treated as separate accounting periods.

This means that, for the first year the rules took effect, the DA often needed to be pro-rated. For example, a single company with an accounting period ending 31 December 2017 which is not a member of a group would usually have a DA for that period of £3.75m (i.e. 9/12 x £5m).

Further guidance

In October 2018 the ATT, alongside the CIOT and ICAEW, wrote to HMRC to request that they act to raise awareness of the new compliance requirements amongst all sizes of businesses, and provide further guidance as to how to comply.

In their response to the ATT, HMRC:

- Issued further guidance on GOV.UK; CTM04800 - Corporation Tax: CT loss reform: contents and CTM05000 - Corporation Tax: restriction on relief for carried-forward losses: contents

- Updated the CT600 notes; Completing your Company Tax Return - GOV.UK

- Updated the main loss relief guidance; CTM04000 - Corporation Tax: trading losses: general: contents and CTM04500 - Corporation Tax: trading losses - relief against total profits: contents

- Updated their Company Losses toolkit – this now has specific questions which prompt companies to check that they have stated the necessary DAs and, if they are a member of a group, that a GAAS has been submitted.

Summary

Carried forward loss relief is restricted for all companies, regardless of size or when the loss arose. Every company, whether standalone or part of a group, should ensure they understand and adhere to the compliance requirements to avoid unnecessary restrictions on their loss relief claims.